Paypal Business Loan Can Be Fun For Everyone

Wiki Article

All About Paypal Business Loan

Table of ContentsUnknown Facts About Paypal Business LoanNot known Incorrect Statements About Paypal Business Loan The smart Trick of Paypal Business Loan That Nobody is DiscussingThe Definitive Guide for Paypal Business LoanLittle Known Questions About Paypal Business Loan.The Ultimate Guide To Paypal Business Loan

Many organization proprietors report feeling stressed when making an application for a tiny company financing. It seems that loan providers are requesting for even more and more documentation with each passing day. In truth, a lot of lending institutions have a conventional exploration listing of records that are required to get and also refine a lending. PayPal Business Loan. Understanding which files will certainly be required and also obtaining that documentation in order before you get your company lending can reduce your stress and anxiety and also speed-up authorization of your funding.Be prepared to offer as much as 2 years of background. Not all lending institutions will call for 2 years on all documents, but several will certainly not call for even more than that. PayPal Business Loan. In any instance, be prepared to furnish all asked for documentation.

Some Ideas on Paypal Business Loan You Should Know

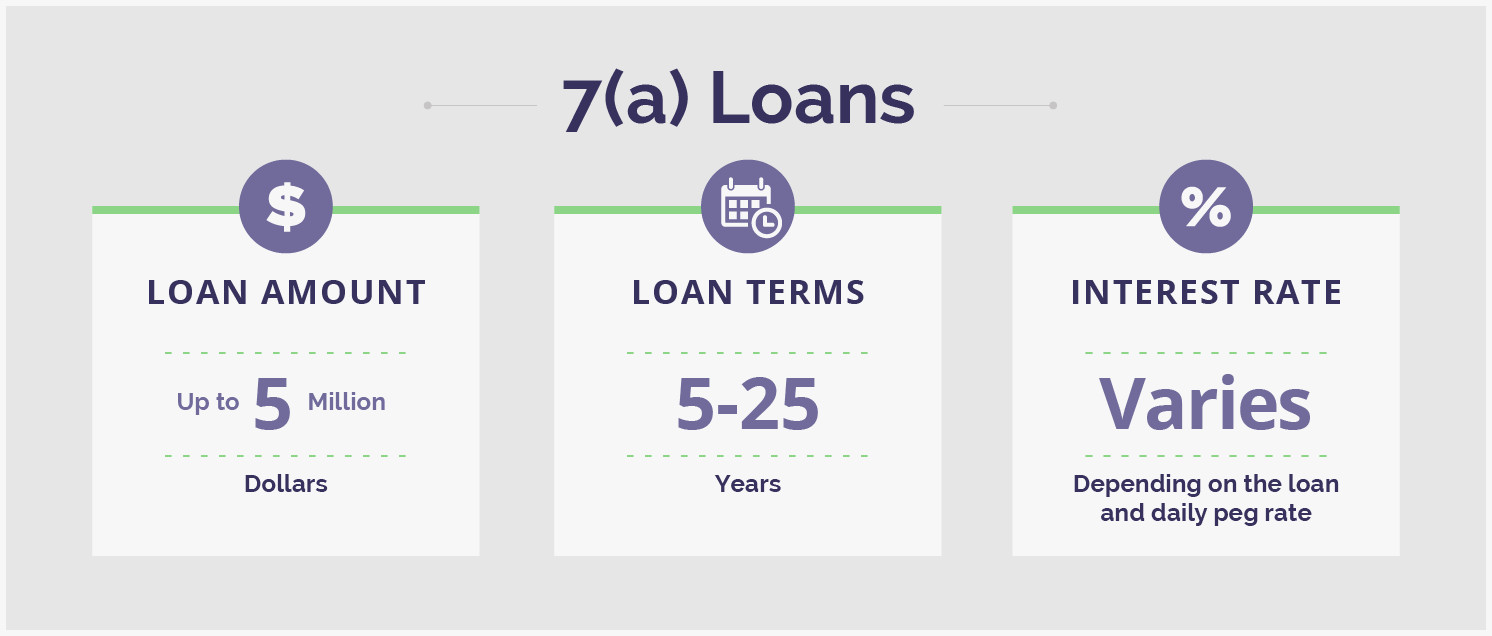

You can choose from a range of business car loan types and also must research your alternatives to find the ideal fit. Consider the kinds of small-business financings you can select from: SBA financings. The SBA partially backs car loans from providing partners, minimizing their danger and also improving access to funding for local business.

Equipment financing is a kind of term financing that can be used to purchase and also expand the price of machinery or equipment for your organization. Usually, the tools is collateral for the funding. If your local business battles with capital because you're waiting on billings to be paid, you can make use of invoice funding, likewise referred to as factoring.

More About Paypal Business Loan

Certain energy-efficient or manufacturing jobs may receive greater than one 504 funding of up to $5. 5 million each. These low-interest finances made straight by the SBA can be utilized to recoup from a declared disaster. Organizations may use calamity fundings to repair or replace machinery as well as equipment, inventory, and also genuine estate that was harmed or damaged.Several small-business car loans can be made use of for a range of company needs. Small-business funding applications are based in component on credit, as well as there are couple of car loan options for services with bad credit scores.

Some on-line lending institutions are taken into consideration alternative loan providers, which can offer more flexibility than business financial institutions because their financing products are less managed. Alternate loan providers offer loans to debtors that or else may not have accessibility to small-business funding, such as startups or companies with a shaky economic history."Small organizations need to be mindful there are multiple channels available for obtaining required funds," states S.

Paypal Business Loan Can Be Fun For Anyone

Online loan providers might offer SBA funding programs. You can also find peer-to-peer lending institutions online that will certainly link your little company with investors ready to money your financing. Size alone won't be adequate to certify for a small-business car loan. You need to convince the loan provider navigate to these guys that your service is worth the danger.For example, you could obtain a various funding for payroll than you would genuine estate. If a lending institution does not use finances in the amount you require, discover one that will. Opting for a reduced amount can worry you with a finance that falls short of appropriately addressing your funding requirements.

The 7-Minute Rule for Paypal Business Loan

Short-term business loans have greater month-to-month repayments than long-term lendings, however you will generally pay less in overall passion due to the fact that you have the car loan for less time. The reverse is additionally true. A longer repayment term might imply reduced regular monthly settlements yet more in total interest fees pop over to these guys over the life of the car loan.Search for a loan provider with the cheapest prices, consisting of: The interest rate is the rate of interest billed on your loan every year, plus all costs and also expenses connected with the finance. Advertised passion prices may be where rates start; a price check can estimate an APR for your small-business lending.

Down settlement needs vary, however expect to spend at the very least 10% to 30% of your very own resources when taking out a financing. An aspect rate is commonly utilized for seller cash money advances as well as short-term company lendings to identify how much you will owe in passion.

Indicators on Paypal Business Loan You Need To Know

Individual fundings. Some personal loans are based upon credit rating, as well as might not supply as much funding as small-business finances. Family members car loans. If relative are able, you might inquire to loan you money for your service. Household financings can conserve you money on passion, but they need to still include a clear payment plan.Advertising and marketing considerations might impact where deals show up on the website however do not impact any content decisions, such as which lending items we cover and exactly how we see this page assess them. This website does not consist of all lender or all lending offers available in the industry.

Sometimes, a tiny organization lending is the response to help you achieve your company goals. Before you begin filling in applications, however, you'll want to have a fundamental understanding of the small company loan landscape: what funding alternatives are available, which ones are preferred, as well as exactly how they function. In this guide, we'll cover those essentials and some alternatives worth considering.

Report this wiki page